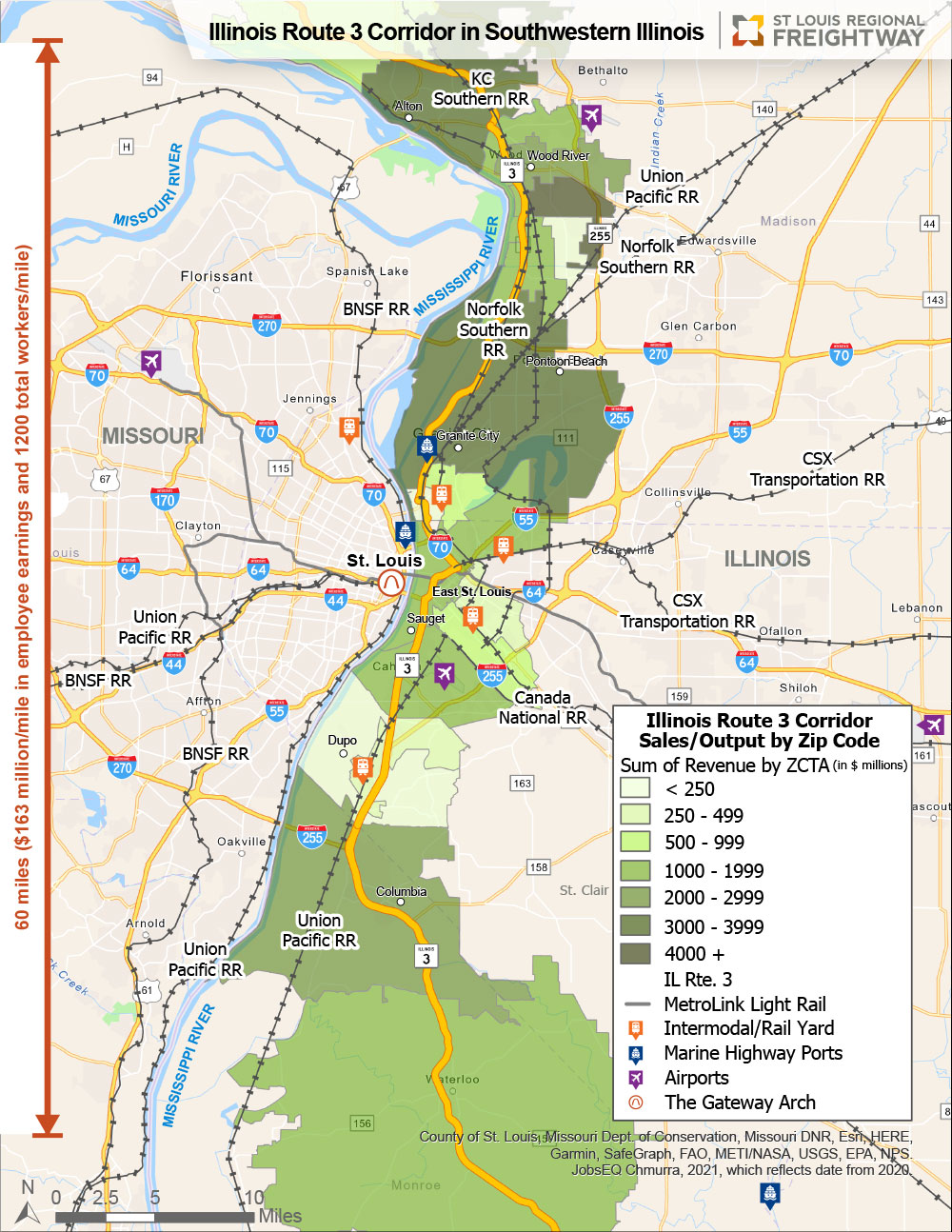

Illinois (IL) Route 3 is the backbone of a 60-mile corridor in southwestern Illinois that runs parallel to St. Louis along the Mississippi River and Interstate 255. This area generates $16 billion in annual business revenue, supports 221,881 direct and indirect jobs, and has an incredible concentration of industrial, warehousing and distribution operations. Check out the materials below to see all that makes this corridor a prime location for existing businesses and future industrial site selection and economic growth.

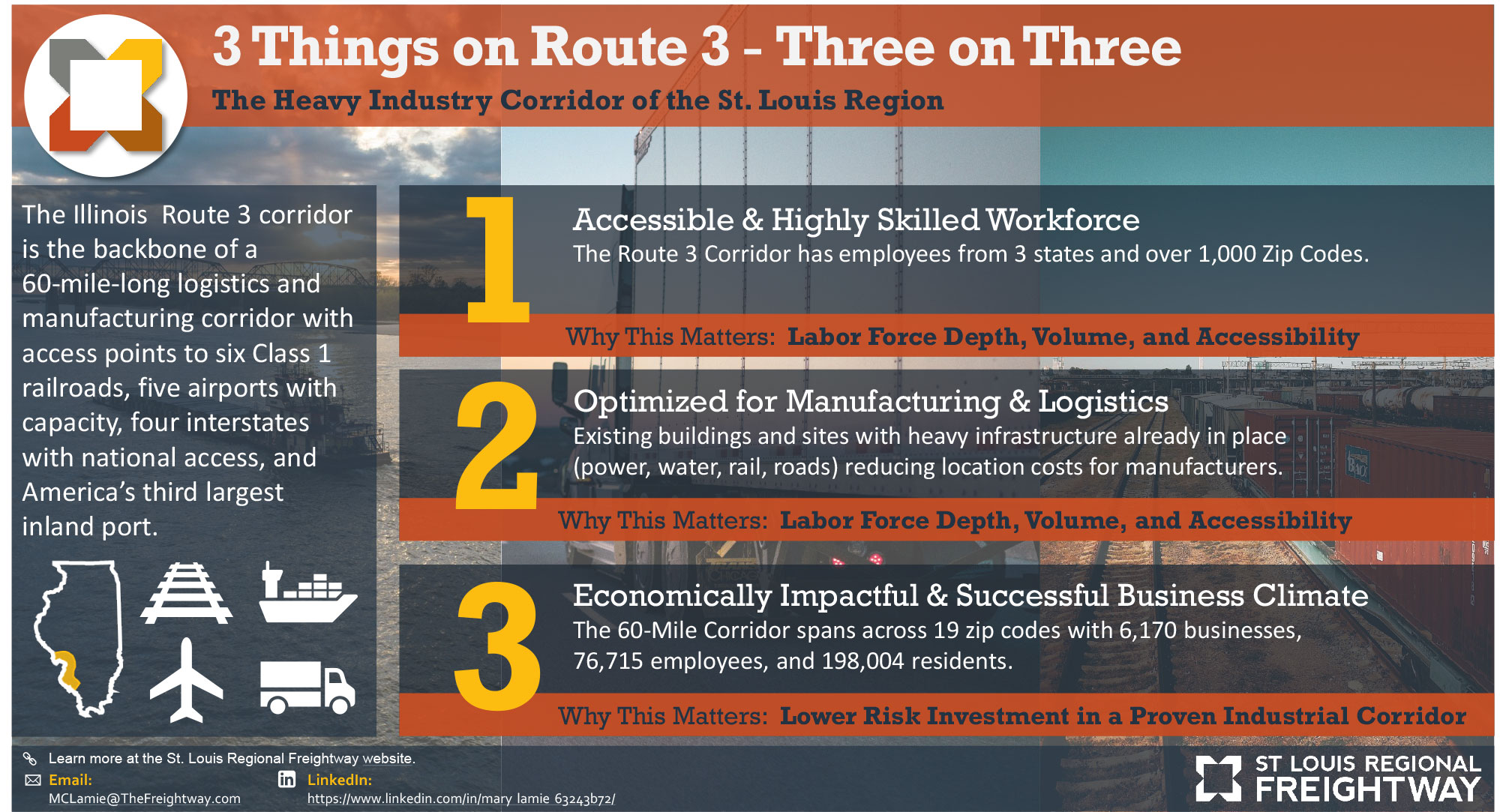

Three Things on Route 3:

Highlights of the economic impact of Illinois Route 3, the backbone of a 60-mile-long corridor in southwestern Illinois that runs parallel to the Mississippi River and Interstate 255.

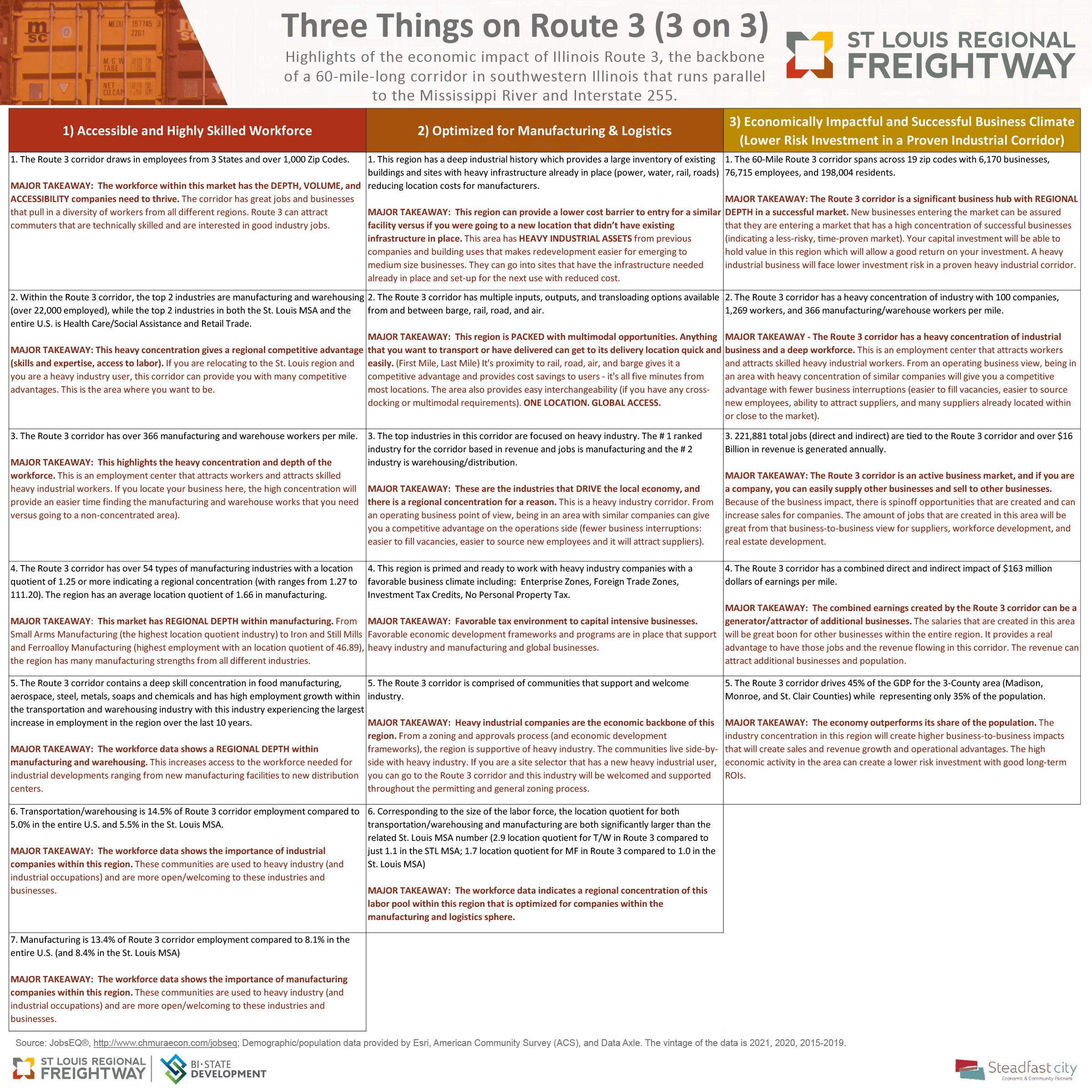

1 Accessible & Highly-Skilled Workforce

The Route 3 corridor draws in employees from 3 States and over 1,000 Zip Codes.

MAJOR TAKEAWAY: The workforce within this market has the DEPTH, VOLUME, and ACCESSIBILITY companies need to thrive. The corridor has great jobs and businesses that pull in a diversity of workers from all different regions. Route 3 can attract commuters that are technically skilled and are interested in good industry jobs.

Within the Route 3 corridor, the top 2 industries are manufacturing and warehousing (over 22,000 employed), while the top 2 industries in both the St. Louis MSA and the entire U.S. is Health Care/Social Assistance and Retail Trade.

MAJOR TAKEAWAY: This heavy concentration gives a regional competitive advantage (skills and expertise, access to labor). If you are relocating to the St. Louis region and you are a heavy industry user, this corridor can provide you with many competitive advantages. This is the area where you want to be.

The Route 3 corridor has over 366 manufacturing and warehouse workers per mile.

MAJOR TAKEAWAY: This highlights the heavy concentration and depth of the workforce. This is an employment center that attracts workers and attracts skilled heavy industrial workers. If you locate your business here, the high concentration will provide an easier time finding the manufacturing and warehouse workers that you need versus going to a non-concentrated area).

The Route 3 corridor has over 54 types of manufacturing industries with a location quotient of 1.25 or more indicating a regional concentration (with ranges from 1.27 to 111.20). The region has an average location quotient of 1.66 in manufacturing.

MAJOR TAKEAWAY: This market has REGIONAL DEPTH within manufacturing. From Small Arms Manufacturing (the highest location quotient industry) to Iron and Still Mills and Ferroalloy Manufacturing (highest employment with a location quotient of 46.89), the region has many manufacturing strengths from all different industries.

The Route 3 corridor contains a deep skill concentration in food manufacturing, aerospace, steel, metals, soaps and chemicals and has high employment growth within the transportation and warehousing industry with this industry experiencing the largest increase in employment in the region over the last 10 years.

MAJOR TAKEAWAY: The workforce data shows a REGIONAL DEPTH within manufacturing and warehousing. This increases access to the workforce needed for industrial developments ranging from new manufacturing facilities to new distribution centers.

Transportation/warehousing is 14.5% of Route 3 corridor employment compared to 5.0% in the entire U.S. and 5.5% in the St. Louis MSA.

MAJOR TAKEAWAY: The workforce data shows the importance of industrial companies within this region. These communities are used to heavy industry (and industrial occupations) and are more open/welcoming to these industries and businesses.

Manufacturing is 13.4% of Route 3 corridor employment compared to 8.1% in the entire U.S. (and 8.4% in the St. Louis MSA)

MAJOR TAKEAWAY: The workforce data shows the importance of industrial companies within this region. These communities are used to heavy industry (and industrial occupations) and are more open/welcoming to these industries and businesses.

2 Optimized for Manufacturing & Logistics

This region has a deep industrial history which provides a large inventory of existing buildings and sites with heavy infrastructure already in place (power, water, rail, roads) reducing location costs for manufacturers.

MAJOR TAKEAWAY: This region can provide a lower cost barrier to entry for a similar facility versus if you were going to a new location that didn’t have existing infrastructure in place. This area has HEAVY INDUSTRIAL ASSETS from previous companies and building uses that makes redevelopment easier for emerging to medium size businesses. They can go into sites that have the infrastructure needed already in place and set-up for the next use with reduced costs.

The Route 3 corridor has multiple inputs, outputs, and transloading options available from and between barge, rail, road, and air.

MAJOR TAKEAWAY: This region is PACKED with multimodal opportunities. Anything that you want to transport or have delivered can get to its delivery location quick and easily. (First Mile, Last Mile) Its proximity to rail, road, air, and barge gives it a competitive advantage and provides cost savings to users—it’s all five minutes from most locations. The area also provides easy interchangeability (if you have any cross-docking or multimodal requirements). ONE LOCATION. GLOBAL ACCESS.

The top industries in this corridor are focused on heavy industry. The #1 ranked industry for the corridor based on revenue and jobs is manufacturing and the #2 industry is warehousing/distribution.

MAJOR TAKEAWAY: These are the industries that DRIVE the local economy, and there is a regional concentration for a reason. This is a heavy industry corridor. From an operating business point of view, being in an area with similar companies can give you a competitive advantage on the operations side (fewer business interruptions: easier to fill vacancies, easier to source new employees and it will attract suppliers).

This region is primed and ready to work with heavy industry companies with a favorable business climate including: Enterprise Zones, Foreign Trade Zones, Investment Tax Credits, No Personal Property Tax.

MAJOR TAKEAWAY: Favorable tax environment to capital intensive businesses. Favorable economic development frameworks and programs are in place that support heavy industry and manufacturing and global businesses.

The Route 3 corridor is comprised of communities that support and welcome industry.

MAJOR TAKEAWAY: Heavy industrial companies are the economic backbone of this region. From a zoning and approvals process (and economic development frameworks), the region is supportive of heavy industry. The communities live side-by-side with heavy industry. If you are a site selector that has a new heavy industrial user, you can go to the Route 3 corridor and this industry will be welcomed and supported throughout the permitting and general zoning process.

Corresponding to the size of the labor force, the location quotient for both transportation/warehousing and manufacturing are both significantly larger than the related St. Louis MSA number (2.9 location quotient for T/W in Route 3 compared to just 1.1 in the STL MSA; 1.7 location quotient for MF in Route 3 compared to 1.0 in the St. Louis MSA)

MAJOR TAKEAWAY: The workforce data indicates a regional concentration of this labor pool within this region that is optimized for companies within the manufacturing and logistics sphere.

3 Economically Impactful & Successful Business Climate (Lower Risk Investment in a Proven Industrial Corridor)

The 60-Mile Route 3 corridor spans across 19 zip codes with 6,170 businesses, 76,715 employees, and 198,004 residents.

MAJOR TAKEAWAY: The Route 3 corridor is a significant business hub with REGIONAL DEPTH in a successful market. New businesses entering the market can be assured that they are entering a market that has a high concentration of successful businesses (indicating a less-risky, time-proven market). Your capital investment will be able to hold value in this region which will allow a good return on your investment. A heavy industrial business will face lower investment risk in a proven heavy industrial corridor.

The Route 3 corridor has a heavy concentration of industry with 100 companies, 1,269 workers, and 366 manufacturing/warehouse workers per mile.

MAJOR TAKEAWAY: The Route 3 corridor has a heavy concentration of industrial business and a deep workforce. This is an employment center that attracts workers and attracts skilled heavy industrial workers. From an operating business view, being in an area with heavy concentration of similar companies will give you a competitive advantage with fewer business interruptions (easier to fill vacancies, easier to source new employees, ability to attract suppliers, and many suppliers already located within or close to the market).

221,881 total jobs (direct and indirect) are tied to the Route 3 corridor and over $16 Billion in revenue is generated annually.

MAJOR TAKEAWAY: The Route 3 corridor is an active business market, and if you are a company, you can easily supply other businesses and sell to other businesses. Because of the business impact, there is spinoff opportunities that are created and can increase sales for companies. The amount of jobs that are created in this area will be great from that business-to-business view for suppliers, workforce development, and real estate development.

The Route 3 corridor has a combined direct and indirect impact of $163 million dollars of earnings per mile.

MAJOR TAKEAWAY: The combined earnings created by the Route 3 corridor can be a generator/attractor of additional businesses. The salaries that are created in this area will be great boon for other businesses within the entire region. It provides a real advantage to have those jobs and the revenue flowing in this corridor. The revenue can attract additional businesses and population.

The Route 3 corridor drives 45% of the GDP for the 3-County area (Madison, Monroe, and St. Clair Counties) while representing only 35% of the population.

MAJOR TAKEAWAY: The economy outperforms its share of the population. The industry concentration in this region will create higher business-to-business impacts that will create sales and revenue growth and operational advantages. The high economic activity in the area can create a lower risk investment with good long-term ROIs.